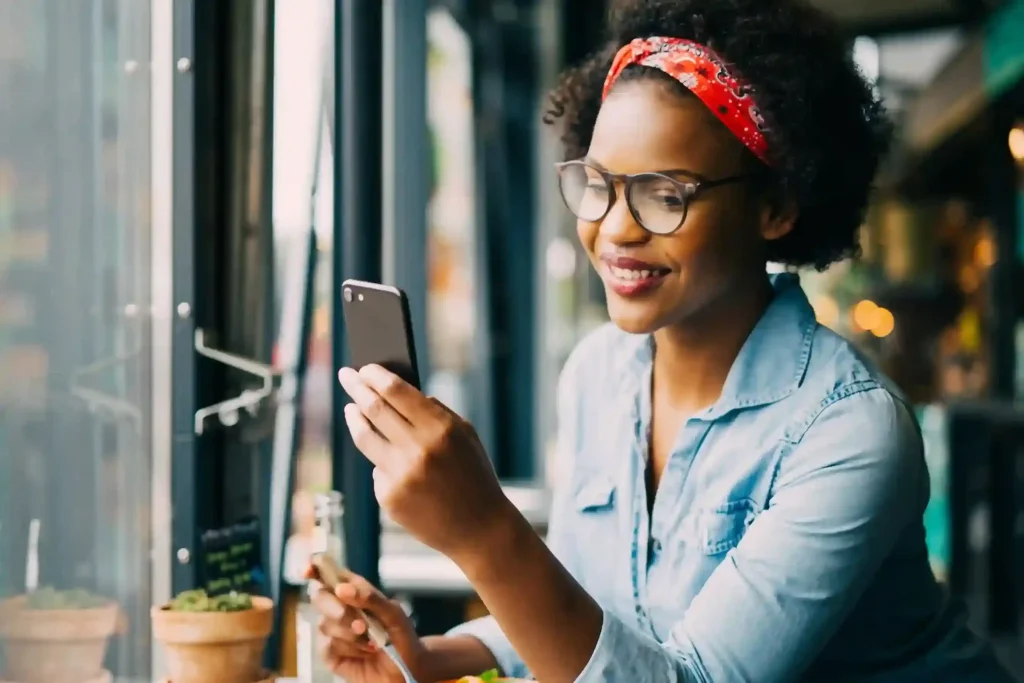

At Flex Finance Loans, we offer a fast and hassle-free loan application process designed to get you the funds you need, when you need them most. Whether you’re looking for a personal loan to cover unexpected expenses, finance a big purchase, or consolidate debt, our streamlined process ensures quick approval. Apply now, and you could be approved in no time, with funds available in your account sooner than you think. Don’t wait—secure your financial freedom today!”

Education loans are a type of financing specifically designed to help students or their families cover the cost of higher education, such as tuition fees, books, accommodation, and other related expenses. These loans are typically unsecured, meaning they don’t require collateral, and approval is based on the borrower’s or co-signer’s creditworthiness, income, and financial background. Education loans are offered by both government institutions and private lenders, with government loans often offering more favorable terms, such as lower interest rates and flexible repayment options.

Once an education loan is approved, the funds are usually disbursed directly to the educational institution or the borrower, depending on the loan agreement. The borrower is typically required to repay the loan in monthly installments after completing their education, with a grace period often provided to allow time for the student to secure employment before payments begin. Interest rates on education loans can be fixed or variable, and the repayment term may range from 5 to 20 years, depending on the loan amount and type. Some loans offer income-driven repayment plans that adjust monthly payments based on the borrower’s earnings after graduation.

WhatsApp us